In this article, we’ll explore capitalization rate and its implications for property valuation and rate of return. We’ve also included a cap rate calculator that also works as a reverse cap rate calculator. Investors can use the cap rate to help determine whether to acquire a commercial rental property.

The capitalization rate is one of the chief pillars of commercial property valuation. Furthermore, it is easy (some would say deceptively easy) to calculate. Conveniently, capitalization rates uses just two inputs, net operating income (NOI) and the property’s current value. Like any equation, the capitalization rate you calculate is only as good as the inputs. However, you might have to estimate the inputs, especially when dealing with new construction. Therefore, developers also use other methods to estimate a property’s return and value. That way, they can gain a clearer picture of how much to spend on building or acquiring a property. They also can better estimate the expected return on investment (ROI) from the property.

We should note that you calculate capitalization rate using an annual figure, NOI. This means that one year’s atypical results can provide a misleading result. In other words, an acquirer might misunderstand the property’s long-term NOI and the NOI growth rate. Therefore, it’s important, whenever possible, to calculate cap rate over several prior years for its true value and trend.

Because the capitalization rate formula depends on net operating income, it is independent of the financing method. In other words, you would get the same NOI whether you acquired for all cash or borrowed 90%. The cost of financing is not part of the NOI, which means you can’t use the cap rate for cash-on-cash return. Rather, you must perform additional calculations to gauge the impact of leverage on your cash-on-cash return.

The following is a Cap Rate Calculator. You enter a property’s current market value and its NOI into the capitalization rate calculator to get cap rate. It also functions as a reverse cap rate calculator. Simply enter a cap rate and NOI, and it returns the current market value of the property.

Cap Rate CalculatorThe cap rate formula is:

Cap Rate = NOI / Current Property Value

Before we explore some examples, let’s discuss the two inputs.

As mentioned earlier, the NOI is an annual figure representing the gross rental income minus all reasonably necessary operating expenses. These expenses include:

You exclude from NOI costs that are capital expenditures, such as installing a new HVAC system. However, capital expenditures generate depreciation, which is an operating expense. Interestingly, this distinguishes NOI from EBITDA. EBITDA is earnings before interest, taxes, depreciation and amortization.

Gross rental income includes not only rent, but also parking fees, service fees and more. Coin-operated laundry and vending machines provide service fees.

Your leasing strategy can affect your expenses. For example, consider a triple-net-lease (aka NNN) property. There, the tenants pay for property taxes, maintenance and building insurance. Clearly, this reduces your operating expenses, but it also means that tenants might insist on lower rents. Therefore, the overall impact of your leasing strategy is situational.

As an example of NOI, consider a property grossing $1.2 million annually with $0.8 million in annual operating expenses. The NOI equals ($1.2 million – $0.8 million = $0.4 million) or $400,000/year. If operating expenses exceed gross revenue, you have a net operating loss (NOL).

A property’s current value depends on current market values of comparable properties. You don’t use the book value for seasoned properties, as this gives unrealistically low values on older property. However, suppose you’re constructing a new building and don’t have good comparables. Then, you can use the cost of construction (less any interest charges) plus a markup to estimate market value.

The following two examples illustrate the effect of capital improvements on capitalization rate.

Imagine an older, 30-unit apartment building comes onto the market for a price of $1.7 million:

Here, we use the same 30-unit apartment building. You estimate that if you spend $10,000 per unit ($10,000 x 30 = $300,000) on capital improvements, you can raise rents by $200/unit:

As you can see, committing an additional $300,000 in capital will increase your capitalization rate from 6.35% to 9.00%.

Another way to view capitalization rate is to think of it as a risk-free rate plus a risk premium. Conventionally, the risk-free rate is the yield on the 3-month Treasury Bill. The risk premium is additional return demanded by investors because of the investment’s risk. In the case of Example 2, let’s assume that the current 3-month T-Bill yields 2.4%:

Cap Rate – Risk-Free Rate = Risk Premium

In other words, investors will require a premium of 6.6% over the risk-free rate to invest in the Example 2 project. Investors require the premium to compensate them for risks, including:

No factor is more important than location. It drives demand for a property and affects the local economy. All things being equal, a better location enables a higher market value for a property, thus a lower capitalization rate. Buyers desire to purchase properties with the as high a cap rate as possible. On the other hand, Sellers desire to sell their properties at the lowest cap rate possible! Consequently, you can charge higher rents when a property is in a desirable location. Of course, properties in good locations cost more to acquire. However, you can charge higher rents for units in these properties. Ironically, sometimes the higher value and higher NOI tend to cancel out, leaving the cap rate about the same.

Typically, commercial properties charge higher rents than do residential properties. The rent you can charge depends in part on the type of commercial property. These include office buildings, multifamily/apartment buildings, retail, recreational and industrial properties.

When supply is short relative to demand, prices go up. Certainly, this is true in real estate. If available inventory is in short supply, you’ll be able to charge higher rents. Conversely, if there is a supply overhang, you will find it hard to raise rents without triggering vacancies. This can lead to higher cap rates, meaning lower values.

Rising interest rates tend to reduce cap rates. The reason is that high rates creates a higher debt service and therefore decreasing cash flow.

The reverse cap rate formula uses cap rate and NOI to calculate the market value of a property:

Current Property Value = NOI / Cap Rate

From Example 2, the NOI was $180,000 and the capitalization rate was 9.00%. The computed property value equals $180,000 / 9.00%, or $2 million. Naturally, this equals the sum of the acquisition price of $1.7 million and the renovation cost of $0.3 million.

You use the reverse cap rate formula to arrive at a buying or selling price for a property. Clearly, if you know, or if you can estimate the NOI, then the property value depends on the chosen cap rate. Typically, you would use the capitalization rates from comparable properties, which might require research to ascertain.

You can use the reverse capitalization rate formula to perform sensitivity analysis on rental property. In this type of analysis, you vary the cap rate to see the effect on property value. For example, in the following table, you can see how higher capitalization rates drive down property value. That’s because you need a lower purchase price to achieve the required rate of return on a high-cap-rate property.

There are several circumstances in which you would not use the cap rate:

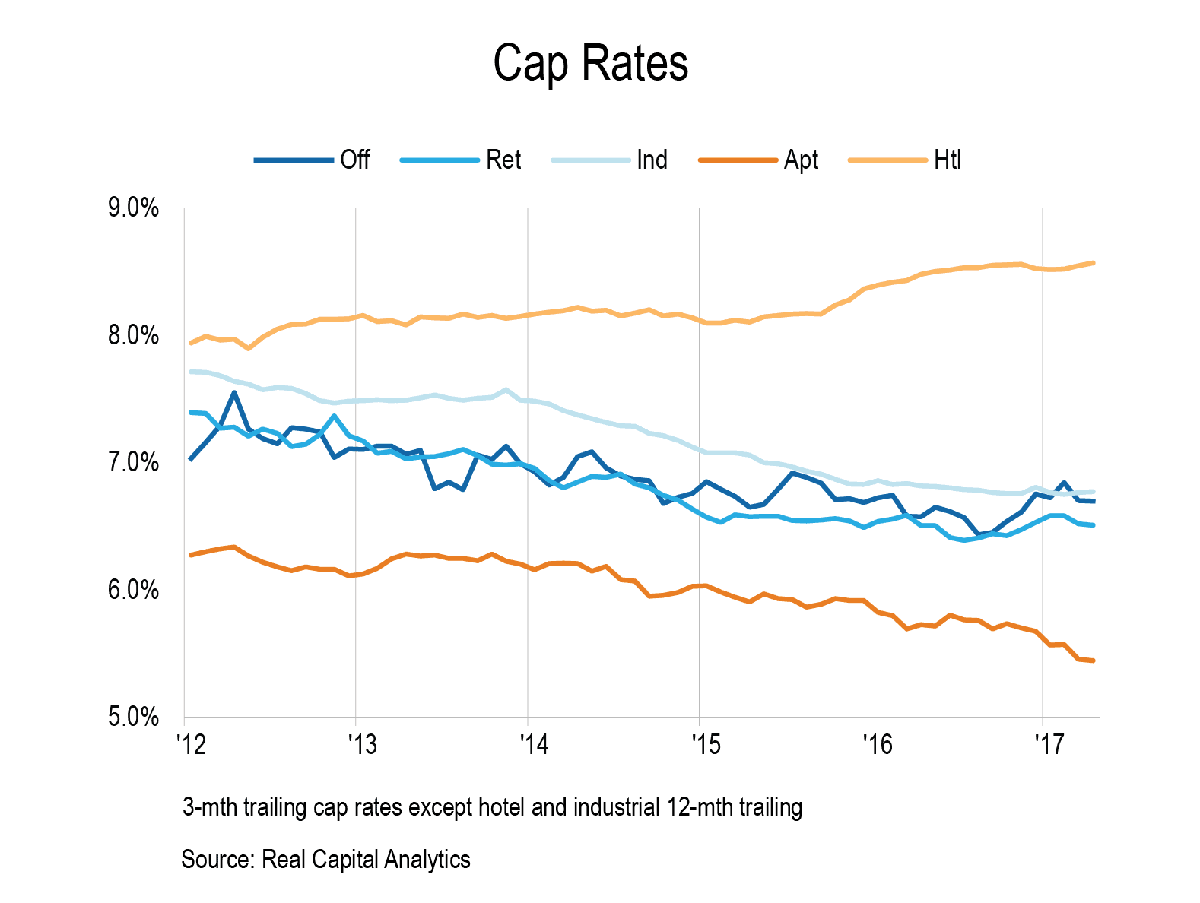

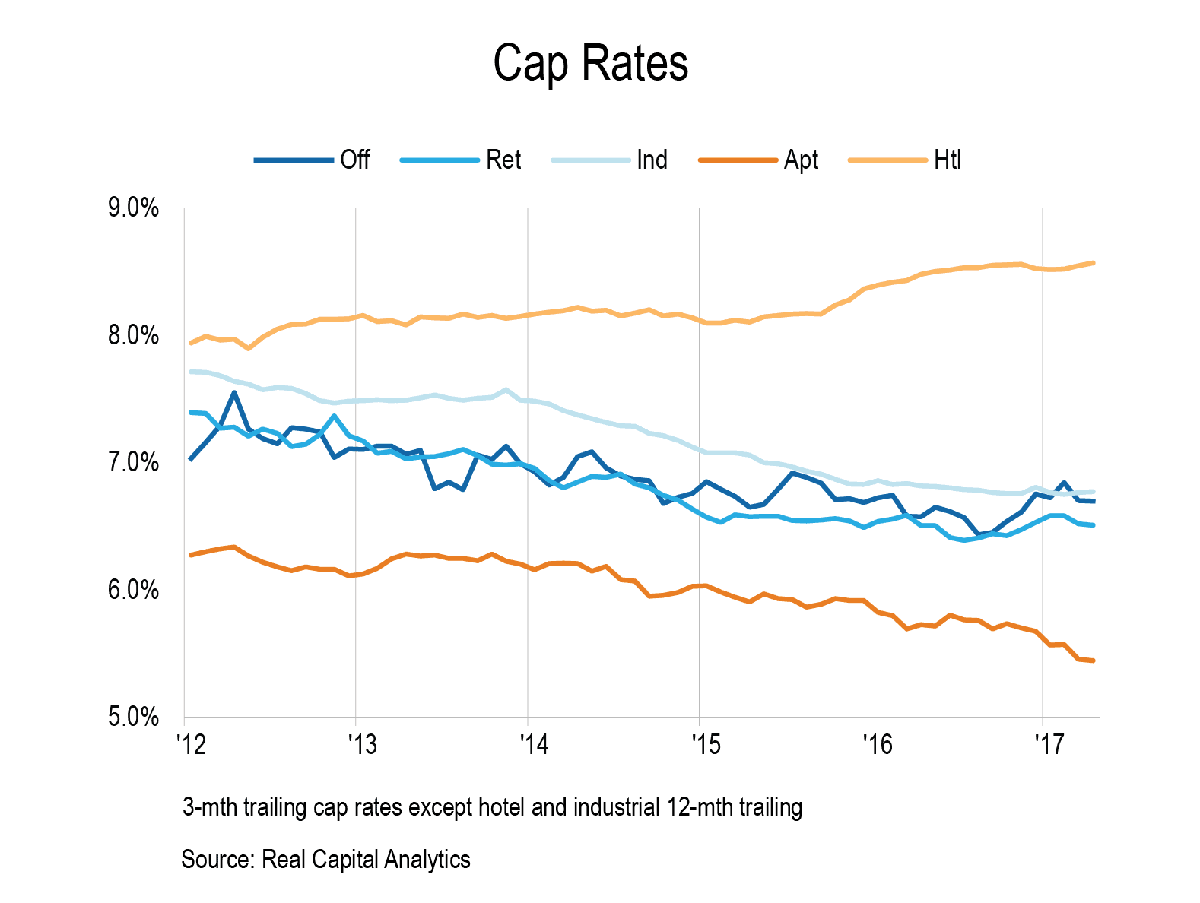

Normally, you will encounter a capitalization rate between 4.00% and 10.00% for commercial property. Cap rates in high-demand areas will be lower than those in less densely-populated areas. Buyers prefer high cap rates because they imply a lower purchase price.

You might expect to see a 4.00% to 6.00% cap rate for multifamily homes in high-demand areas. However, you might encounter cap rates of 9.00% or higher for multifamily property in low-demand areas. Much depends on the availability of competing units when applying the cap rate formula.

As mentioned above, a higher cap rate is better for buyers, because of the inverse relationship to price. For sellers, a lower cap rate is better. The best situation is for a buyer to acquire a high-cap-rate property and improve it. This raises the property’s NOI and lowers its capitalization rate.

It states that you should bid a purchase price in which monthly rent income equals 2% of the price. For example, a $1 million property should generate monthly rental income of at least $20,000. The rule is of little value, since it ignores the property’s condition and your net cash flow after expenses.

Ronny was a pleasure to work with and is extremely knowledgeable. His hard work was never ending until the job was done. They handled a complex lease and guided us through entire process, including the paperwork. Not to mention a below market lease rate and more than all the features we needed in a site. We later used Assets America for a unique equipment financing deal where once again Ronny and team exceeded our expectations and our timeline. Thank you to Assets America for your highly professional service!

exp MFGroup Great experience with Assets AmericaGreat experience with Assets America. Fast turn around. Had a lender in place in 30 minutes looking to do the deal. Totally amazing. Highly recommend them to anyone looking for financing. Ronny is fantastic. Give them a call if the deal makes sense they can get it funded. Referring all our clients.

Assets America guided us every step of the wayAssets America guided us every step of the way in finding and leasing our large industrial building with attached offices. They handled all of the complex lease negotiations and contractual paperwork. Ultimately, we received exactly the space we needed along with a lower than market per square foot pricing, lease length and end of term options we requested. In addition to the real estate lease, Assets America utilized their decades-long financial expertise to negotiate fantastic rates and terms on our large and very unique multimillion dollar equipment purchase/lease. We were thankful for how promptly and consistently they kept us informed and up to date on each step of our journey. They were always available to answer each and every one of our questions. Overall, they provided my team with a fantastic and highly professional service!

The company is very capable, I would recommend Assets AmericaAssets America was responsible for arranging financing for two of my multi million dollar commercial projects. At the time of financing, it was extremely difficult to obtain bank financing for commercial real estate. Not only was Assets America successful, they were able to obtain an interest rate lower than going rates. The company is very capable, I would recommend Assets America to any company requiring commercial financing.

Assets America was incredibly helpful and professionalAssets America was incredibly helpful and professional in assisting us in purchasing our property. It was great to have such knowledgeable and super-experienced, licensed pros in our corner, pros upon which we could fully rely. They helped and successfully guided us to beat out 9 other competing offers! They were excellent at communicating with us at all times and they were extremely responsive. Having them on our team meant that we could always receive truthful, timely and accurate answers to our questions. We would most definitely utilize their services again and again for all of our real estate needs.

Assets America is a great company to work withAssets America is a great company to work with. No hassles. Recommend them to everyone. Professional, fast response time and definitely gets the job done.

Great experienceRonny at Assets America has been invaluable to us and definitely is tops in his field. Great experience. Would refer them to all our business associates.

We were very pleased with Assets America’s expertiseWe were very pleased with Assets America’s expertise and prompt response to our inquiry. They were very straight forward with us and helped a great deal. We referred them to all our business associates.

Worked with this company for decadesI’ve worked with this company for decades. They are reputable, knowledgeable, and ethical with proven results. I highly recommend them to anyone needing commercial financing.

Top-notch professionalRonny was incredibly adept and responsive – top-notch professional who arranged impressive term sheets.

Assets America helped us survive a very difficult timeAssets America helped us survive a very difficult time and we most definitely give them 5 stars!

Gave me direction to goRonny was very friendly and though we were unable to make something happen at the moment he gave me some direction to go.

Highly recommend them for any type of commercial financingMy business partner and I were looking to purchase a retail shopping center in southern California. We sought out the services of Ronny, CFO of Assets America. Ronny found us several commercial properties which met our desired needs. We chose the property we liked best, and Ronny went to work. He negotiated very aggressively on our behalf. We came to terms with the Seller, entered into a purchase agreement and opened escrow. Additionally, we needed 80 percent financing on our multimillion-dollar purchase. Assets America also handled the commercial loan for us. They were our One-Stop-Shop. They obtained fantastic, low, fixed rate insurance money for us. So, Assets America handled both the sale and the loan for us and successfully closed our escrow within the time frame stated in the purchase agreement. Ronny did and performed exactly as he said he would. Ronny and his company are true professionals. In this day and age, it’s especially rare and wonderful to work with a person who actually does what he says he will do. We recommend them to anyone needing any type of commercial real estate transaction and we further highly recommend them for any type of commercial financing. They were diligent and forthright on both accounts and brought our deal to a successful closing.